Turn Tip Credits Into Trusted Advisory

The Complete System to Build High-Value Relationships with Service Industry Clients

Business owners need advisors who understand their business.

Not just accountants who file forms. With H.R.1 changes, new IRS enforcement and the upcoming 2026 W-2 requirements, they're looking for someone who can guide them through complexity with confidence.

Tip Credit in a Box helps you become that trusted advisor. Yes, you can sell advisory services, but you're also building relationships by solving real problems.

Get started by clicking the button below.

GET ACCESS

What You’ll Get

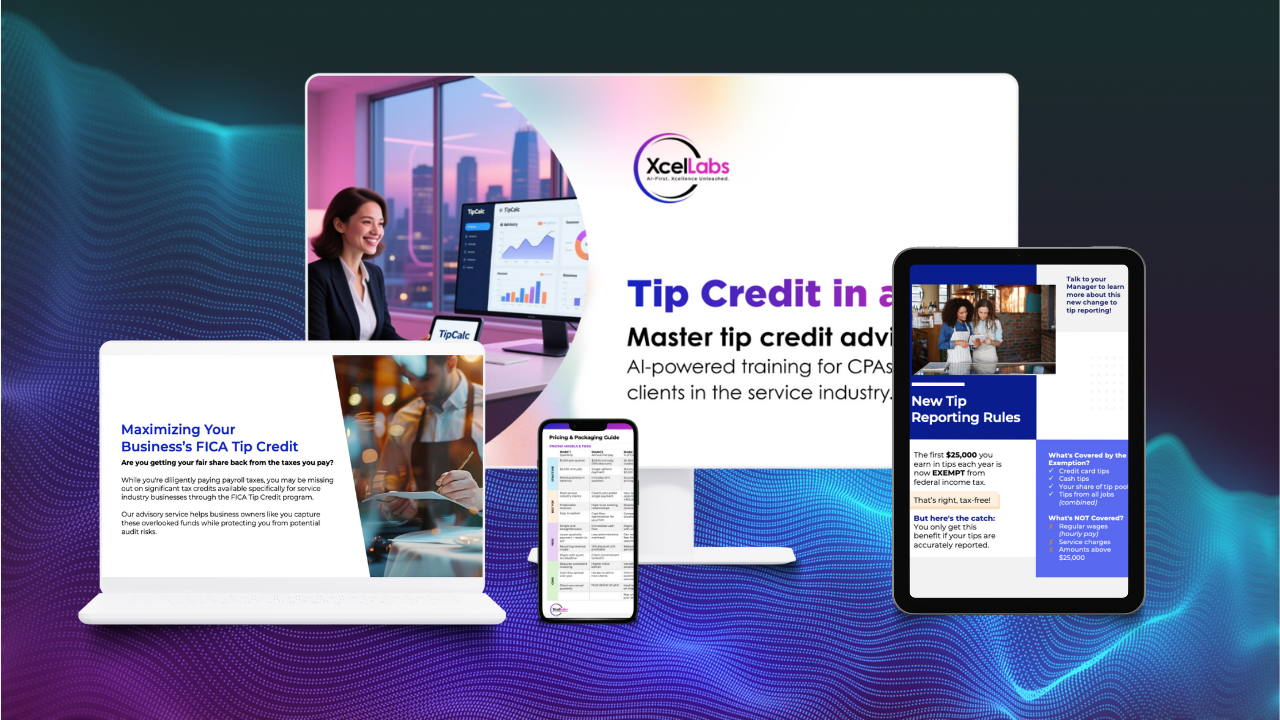

Tip Credit in a Box provides you with everything you need to launch a tip credit advisory service. From tools to frameworks to an AI coach, it contains everything you need to deliver real results.

Quick Calc Tool - 5-line estimator to instantly identify which clients have the biggest opportunities

Access to Tip Calc - Compliance-driven calculator, where 15% of credit will be required to file

Advisory Platform Access - Step-by-step guidance with Navi AI coaching for client conversations and implementation

Client Engagement Package - Email templates, presentation decks, pricing guides and sample engagement letters

Employee Communication Materials - One-pagers, FAQs and templates to help clients educate their staff

Implementation Roadmap - Complete checklist from initial analysis through ongoing quarterly maintenance

6 months of Navi AI Access - Practice your pitch, refine conversations and get real-time coaching

Who This Is For

Tip Credit in a Box is designed for CPAs and accountants who want to:

Add high-value advisory service to their practice

Build recurring revenue with hospitality and restaurant clients

Help clients capture significant tax credits they're currently missing

Help clients capture significant tax credits they're currently missing

Position themselves as specialized advisors in the service industry

Leverage AI tools to scale advisory services efficiently

Whether you have one tip client or twenty, if you're looking for a proven way to add immediate value and generate predictable revenue, this is your roadmap.

BUY NOW

Why This Matters Now

Recent regulatory changes have created both opportunity and complexity for business owners. H.R.1 (2025) preserved the FICA Tip Credit at 7.65% of qualifying tips — making it the primary remaining tax strategy for tipped clients — while simultaneously increasing IRS enforcement and scrutiny. At the same time, new employee incentives like the $25,000 tip deduction are giving staff real reasons to report accurately, fundamentally changing tip reporting dynamics.

Add to this the upcoming 2026 W-2 changes that will include occupation codes, making discrepancies easier for the IRS to detect, and you have a landscape where business owners need guidance more than ever. Many are still working with post-COVID compensation structures they haven't fully reconciled, leaving significant credits unclaimed.

Your clients are navigating this complexity right now — and they need an advisor who understands it.

GET ACCESS